News writer, Interviewer

Ohio's gaming industry is booming, but there's room for growth, according to a recent report. House Representatives Jay Edwards, Jeff LaRe, and Cindy Abrams see big potential in iGaming and iLottery.

While online sports betting is already legal, iLottery and iGaming haven't gotten the green light yet. Brick-and-mortar casinos and lottery retailers worry online options would hurt their business.

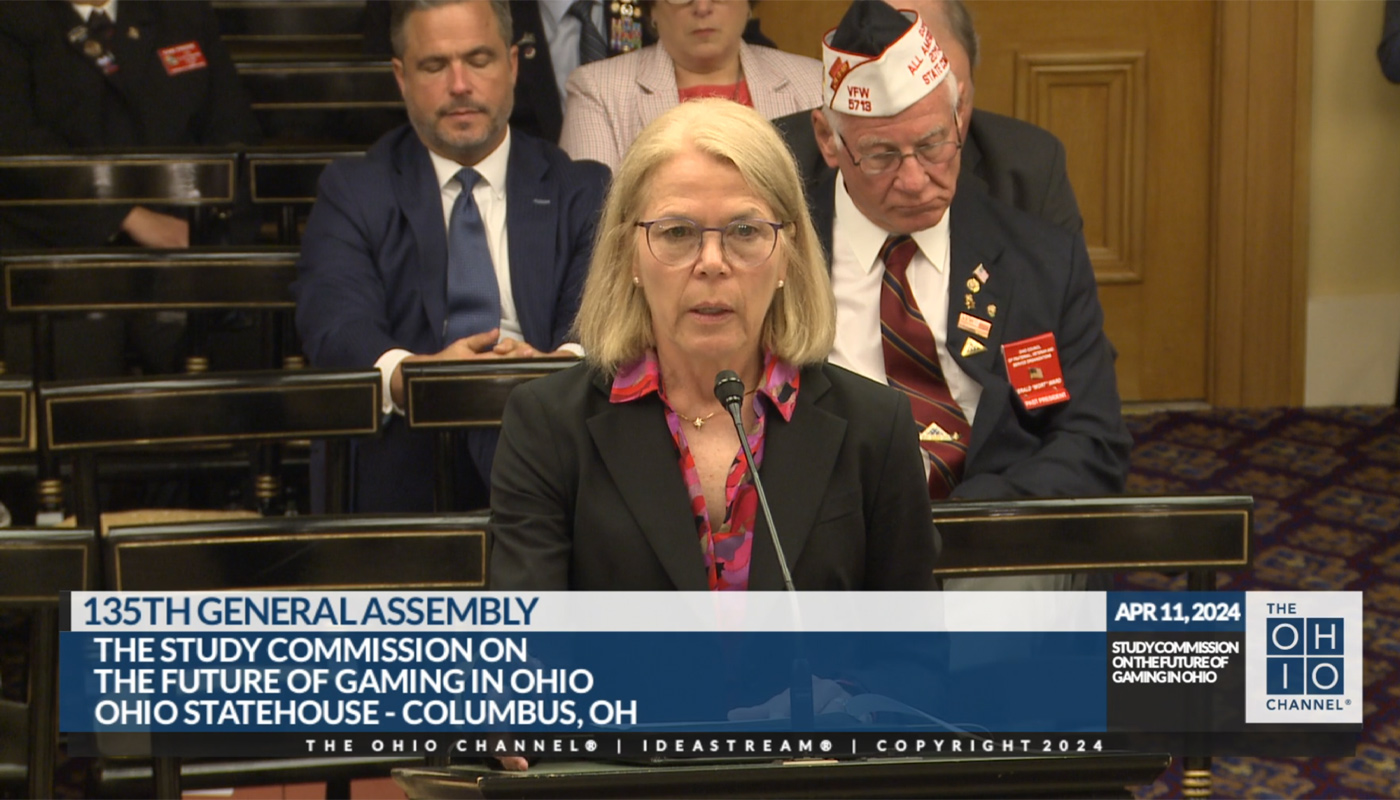

The House Study Commission on the Future of Gaming in Ohio disagrees.

The report found that:

There has been a lot of discussion around legalizing forms of iGaming and iLottery that would allow users the same freedom that online sports gaming does now. However, there has been pushback from the brick-and-mortar gaming facilities and lottery retailers, who have been worried about the effect that would have on their annual revenue with decreased in-person participation.

They point to other states that have seen success with iLottery and iGaming.

Pennsylvania, for instance, actually increased traditional lottery sales by nearly 20% after the introduction of iLottery. Kentucky saw an even more dramatic jump, with in-store lottery sales surging by an impressive 56% following the launch of iLottery.

Their optimism is backed up by data from other states. The report highlights:

Looking at other states who have implemented either or both iLottery and iGaming, we see significant increases to tax revenues generated with greater participation but also that in-person sales continued to increase.

In other words, iLottery and iGaming could be a rising tide that lifts all boats.

The study highlights the explosive growth of online casino gaming in nearby states. Connecticut's iGaming market has climbed by 44.7% in 2023 alone. Michigan provides an even more compelling case. Since legalizing online casino games in 2021, the state has raked in a monumental $3.6 billion, solidifying its position as the nation's leader in the iGaming market.

More revenue for education?

The Ohio Lottery is a large contributor to education funding, generating $1.4 billion for the Lottery Profits Education Fund in 2023 alone. That's a significant chunk of change that benefits K-12, vocational, and special education programs across the state.

However, the report by the House Study Commission hints at an even brighter future.

In the report, Commission members Edwards, LaRe, and Abrams wrote:

These tax revenue benefits to the state — and funding that could be provided to our K-12 education system — cannot be overlooked.

Tax concerns and college prop bets

In addition to the iLottery recommendations, the report criticizes House Bill 33, which doubled the tax rate on sports betting, calling it "premature" and a potential barrier to further industry growth. They argue that this move, which was implemented shortly after launch, discouraged investment.

The commission also challenges the ban on college prop bets. With the rise of NIL, they reason that college athletes are essentially professionals now, making these bets no different than pro sports wagers.

The future of gaming in Ohio

With the potential for increased revenue and a boost to education funding, iGaming, and iLottery could be a winning proposition for Ohio. Whether these options are legalized remains to be seen, but the House Study Commission's report has certainly sparked the conversation.

Comments