News writer

For many of us, the idea of coming into substantial, life-changing wealth abruptly and without forewarning is so mysterious and alien that it is effectively an empty void—a category of the human condition from which we have zero experiences to draw on.

Such empty voids can serve as particularly fertile ground for the collective imagination, though, as alluring vacuums where all manner of wild speculation, apocryphal anecdotes, and brazen mythologizing build up and gradually accumulate into something unreal but convincing. It is in this manner that we haphazardly dream up, ponder, and breathlessly gossip about our caricatures of the suddenly-rich. There's the billionaire tech entrepreneur jetting to private islands and absconding via blinding white superyachts; the addled heir to a vast family fortune succumbing to a wolfish demimonde of unsavory enablers and sycophants; the lottery winner getting carried off at full career into the high life only to return, just a few years later, careworn, jaded, and broke.

In producing and subscribing to these evocative sketches and well-traveled archetypes, we have a tendency to emphasize the propensity for opulence and excess—leaning into our collective assumption that those individuals who come into sudden wealth will put their outsized windfalls toward the realization of grandiose fantasies or the indulgence of base, hedonistic appetites. Our ideas about sudden beneficiaries of great wealth, in other words, are rooted in extreme, larger-than-life narratives that match the sheer size and extravagance of the fortune itself. We crave and conceive of stories and characters who are glutted with glamor, greed, and conspicuous consumption. We want those who come into extraordinary windfalls to have sweeping, cinematic arcs to match.

But becoming rich—especially when it happens all at once, in a furious downpour—is about more than just the gaudy, hyperbolic manifestations of wealth and their corresponding pitfalls. There are a myriad of other significant adjustments to consider, including how such a sudden transformation in our net worth will affect our relationships, careers, and longstanding sense of self. But when we rely too heavily on these captivating vignettes and their moralizing undercurrents, we risk overlooking this complex, nuanced terrain. It is in this uncertain, liminal gray zone where the psychologist Stephen Goldbart found himself when he coined the term “sudden wealth syndrome” to describe a set of feelings, experiences, and interpersonal dynamics that complicate and even belie our expectations of what it means to “win the jackpot.”

Silicon Valley blues

When Goldbart, a cofounder of the Money, Meaning, and Choices Institute (MMCI) in San Francisco, began working with Bay Area entrepreneurs in the 1990s, it was at the very outset of Silicon Valley's heady, propulsive gold rush. It was a time of excitement, fervor, and boundless possibility—the dawn of the internet, the ascendance of the personal computer, the aggressive, paradigm-shattering ambitions of scrappy startups. An entire industry was leaping into existence, hitting the ground at a dead sprint, and the resulting financial boon was making a number of those entrepreneurs fabulously wealthy.

As Goldbart spent more and more time with these individuals, he was surprised to find that many of them were experiencing a range of emotions far different from the mixture of joy, fulfillment, and effervescent pride most of us would associate with such rapid personal achievement and financial success. But though many of Goldbart's clients were enjoying those feelings, the technologists were also navigating a constellation of more negative thoughts, too, ones related to the ways in which such a drastic, even shocking spike in personal wealth can confound and bewilder a person's psyche.

Goldbart would come to use the term sudden wealth syndrome to describe this array of thorny, interconnected psychological issues. Those suffering from sudden wealth syndrome, or SWS, Goldbart writes:

[Those suffering from sudden wealth syndrome] are people whose concerns about money become painful ruminations that ruin their daily lives, people whose feelings of confusion and guilt lead to self-destructive behaviors, people whose families are ripped apart and whose lives over time become devastated.

Such a gloomy litany of woes may come off as somewhat extreme or exaggerated, perhaps even straining credulity for some.

How could it be, you might ask, that such fantastic windfalls, with all their capacity for birthing new possibilities, cementing security, and vanquishing many of life's most persistent stressors, could wreak such havoc on an individual? Delving into the specific symptoms of SWS in some detail may help explain these harrowing scenarios—and, in the process, throw light on the gap between our tidy conceptions of the suddenly-rich and the more intricate, convoluted realities concealed behind those pervasive stereotypes.

Reversal of fortune

Popular ideas and narratives surrounding sudden wealth tend to focus primarily on its photogenic outward expressions: the glittering luxury sports car, the chic address ensconced among picturesque hills, or the impulsive extravagance of jaunting to exotic locales. But for people suffering from SWS, wealth can be just as much an inward-facing experience: an internal struggle with unwanted, even intrusive thoughts related to their nascent fortunes. These thoughts are typically driven by fear, paranoia, and gnawing uncertainty that all circle the same dread-inducing hypothetical: the possibility of losing their money just as rapidly as they came into it. These concerns, one of the hallmarks of SWS, often snowball into full-fledged ruminations as the newly wealthy dwell on a range of potential scenarios, repetitively and exhaustingly, struggling to pull themselves out of negative thought cycles that may strengthen their grip over time.

What's worse is that these ruminations often assume seemingly convincing, credible forms. There's the possibility of losing one's wealth to the IRS, becoming the target of avaricious lawsuits, or shouldering an ever-increasing number of financial responsibilities for dependent loved ones. Because they may bear a few small grains of truth, these paranoid figments can gain deep traction in the SWS sufferer's mind to the point where they struggle to distinguish real, practical concerns from these products of delusive thinking.

Whatever the imagined set of circumstances may be, these intrusive, cyclical thoughts have the potential to interfere with a person's daily life, affecting their well-being and relationships and even swelling into more serious psychological issues.

“Ticker shock”

A term popularized in the 1990s to describe the toxic, obsessive relationship some people have with the stock market, the phenomenon of ticker shock can have a potent impact on newly wealthy individuals whose net worth is disproportionately tied to their company in the form of stock options or other investments. Ticker shock creates a perpetual state of anxiety—that, given the right conditions, can easily tip into a panic—as one is forced to constantly negotiate the market's volatility and their resulting feelings of powerlessness over their own financial fates. Those suffering from this effect are at the mercy of surges, swings, and streaks, and this ceaseless instability can have a profound impact on their emotional well-being, self-esteem, and broader perspective on their lives.

Identity crisis

We all understand on an intuitive level that coming into sudden and significant wealth can change a person. What we're much less conversant in is what it's like to be on the receiving end of those changes—to have to reconcile all the lofty trappings of affluence with those crucial distinguishing features that make a person who they are. People grappling with SWS may struggle to find an equilibrium between their established sense of self and the ways in which their newfound wealth is reshaping everything around them, from the home they live in and the people they socialize with to the ways they're treated by peers and colleagues.

For the suddenly wealthy, the dizzying panoply of new opportunities, privileges, and freedoms can quickly overshadow many of the most important cornerstones of their identity. Without the right amount of deliberation and restraint, individuals can find themselves enveloped in a beguiling, rarefied world that only materializes in the wake of their windfall as they gradually lose touch with the person who vaulted them there in the first place.

On the other end of the spectrum, beneficiaries of sudden wealth may become mired in internal conflict over the threats their newfound affluence poses to their sense of self and identity. To stave off these perceived hazards, they stage a kind of categorical resistance to any potential changes, clinging stubbornly to the lifestyle, obligations, and material circumstances they had prior to their fortunes. As well-intentioned as this sort of principled stand may appear to be, it does individuals a disservice by robbing them of the opportunity to adapt, grow, and leverage their wealth in ways that advance and deepen their identities rather than jeopardize them.

New dynamics in old relationships

Finally, sudden wealth can radically alter a person's relationships with family, friends, and other loved ones in a host of challenging, potentially problematic ways. Certain individuals may harbor a specific set of expectations about how a newly acquired fortune should be shared, while others might attempt to ingratiate themselves in the tacit hope of riding the beneficiary's coattails into a more posh, extravagant milieu. Family members in seemingly difficult or even dire circumstances, meanwhile, could see the windfall as a precious opportunity to better their own lots through heartfelt appeals.

For the newly wealthy, navigating these subtly altered relationships can be an exhausting proposition. Forced to parse the shifting sands of unclear motivations and surreptitious agendas among their loved ones, they may grow increasingly skeptical or even paranoid about what were once honest, unaffected bonds. Over time, this endless scrutiny can give way to jaded cynicism as they begin perceiving everyone around them with suspicion and find it easier to keep even longstanding friends and loved ones at arm's length. Unable to come to terms with the regrettable truth that their windfall will likely leave no relationship completely unchanged, these SWS sufferers risk slipping into states of self-induced isolation and even estrangement from those with whom they were once close.

Combating SWS

Fortunately, sudden wealth syndrome is not an inevitability for those who find themselves on the receiving end of precipitous fortunes. People entering this unprecedented stage of their lives with clear eyes and a concrete plan for negotiating the potential psychological challenges will find themselves far better equipped to actually enjoy the fruits of their luck or labor.

To keep the dynamics with friends and family from becoming overly fraught, individuals can take preventative measures by setting clear, definitive boundaries. This could mean telling one's inner circle, in frank, matter-of-fact terms, that they should not expect the windfall to transform their lives into visions of glamorous privilege. Other conversations might be initiated with specific individuals, with the beneficiary outlining the ways they do and do not see their fortune altering the relationship.

The suddenly wealthy, in other words, should be setting expectations from the outset, letting those close to them know that their funds are a finite resource and will not be bankrolling quixotic fantasies or unsustainable lifestyles. While potentially awkward initially, these candid conversations can create clarity and transparency, jettisoning the kind of ambiguity and unrealistic hopes that spawn confusion, suspicion, and embitterment. When everyone is on the same page, the suddenly wealthy stand a much better chance of preserving their preexisting relationships and eluding the interpersonal symptoms of SWS.

As we've discussed, even a person's seemingly deep-rooted sense of self can be imperiled by the potent forces of sudden wealth. To curtail the ways an infusion of material resources can compromise, distort, or even subvert one's identity, individuals should implement guardrails and utilize their resources with a clear sense of intentionality. They would be well served by carefully thinking through any investments and expenditures rather than acting on impulse and need not tolerate any acquaintances or other hangers-on peddling financial obligations masquerading as “opportunities.” Above all, they should continue to trust their own instincts—the ones that guided them to such advantageous circumstances in the first place. (A past piece on the site explores techniques to stay grounded during this exuberant time.)

Amid the bustle and whirl of affluence, where there are so many new players, interests, and competing voices, one's inner compass matters more than ever.

To avoid the kind of “identity confusion” cited by Goldbart, in which one becomes bogged down by ambivalence about their novel wealth and the abundance of choices it creates, beneficiaries may want to clearly delineate the ways they want their financial resources to change their lives, and the ways they don't. Operating with guiding principles and explicit objectives can help individuals harness the potential and possibilities their capital creates rather than spurning them for fear of losing control.

The stress that comes with managing a personal windfall, meanwhile, is probably not sufficiently understood or appreciated by the general public. After all, we freely invoke the term “financial security” to refer to the kind of wealth that permanently resolves all our material troubles, and fretting over a fortune stands in stark contradiction to such conventional wisdom. Nevertheless, sufferers of SWS unquestionably do struggle with irrational fears over losing their money, which is why working with a financial advisor or other wealth management expert can be critical. These professionals can give the suddenly wealthy a sense of impartial objectivity, keeping their perspective grounded and helping them distinguish between legitimate threats and the cyclical thoughts that proliferate when reasonable monetary concerns become pathological.

In making a final appraisal of sudden wealth syndrome, it's important to make note of two crucial points. First, SWS is not a psychological condition officially recognized by the Diagnostic and Statistical Manual of Mental Disorders (DSM), the widely accepted bible of psychiatry. Rather, it might be better thought of as a cluster of observable behavior changes that can overlap with anxiety, depression, and other mental health conditions.

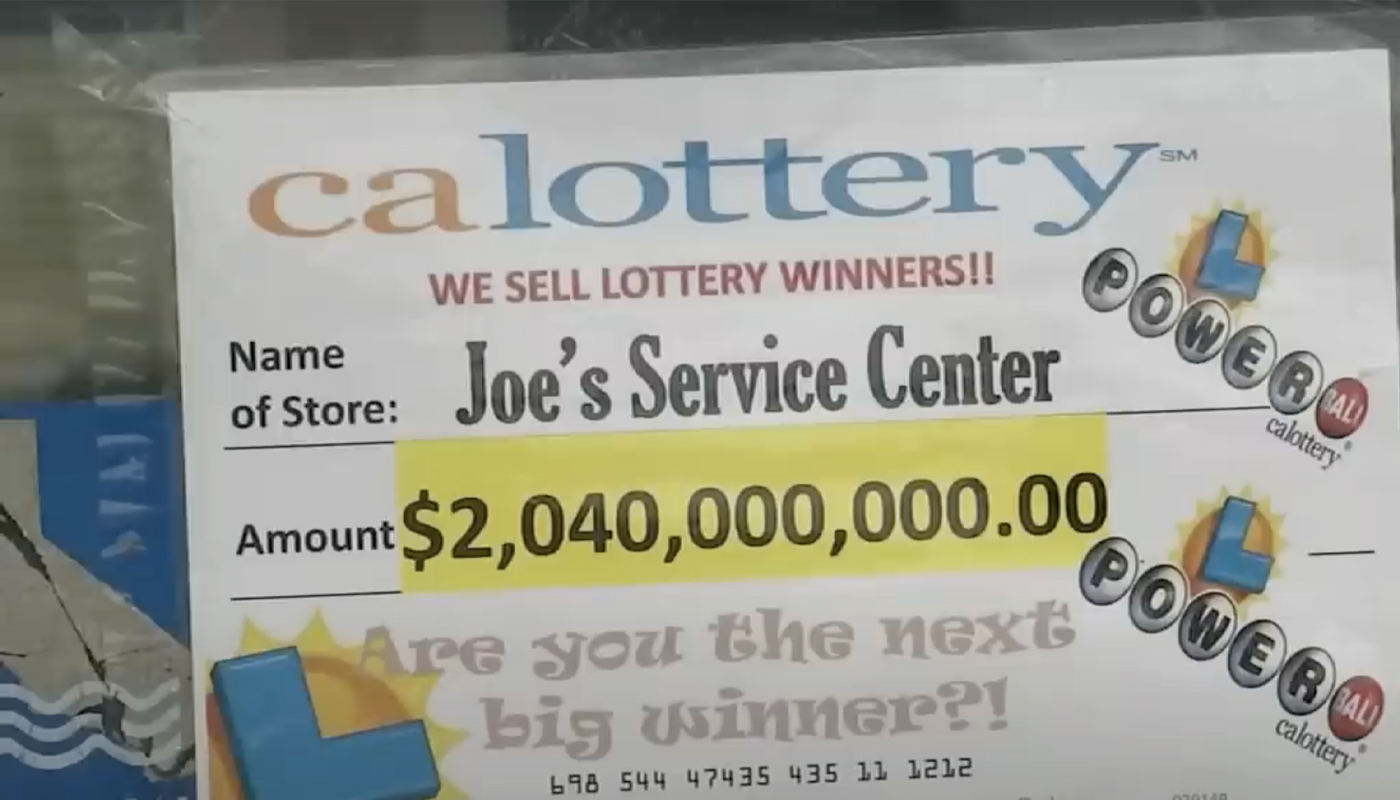

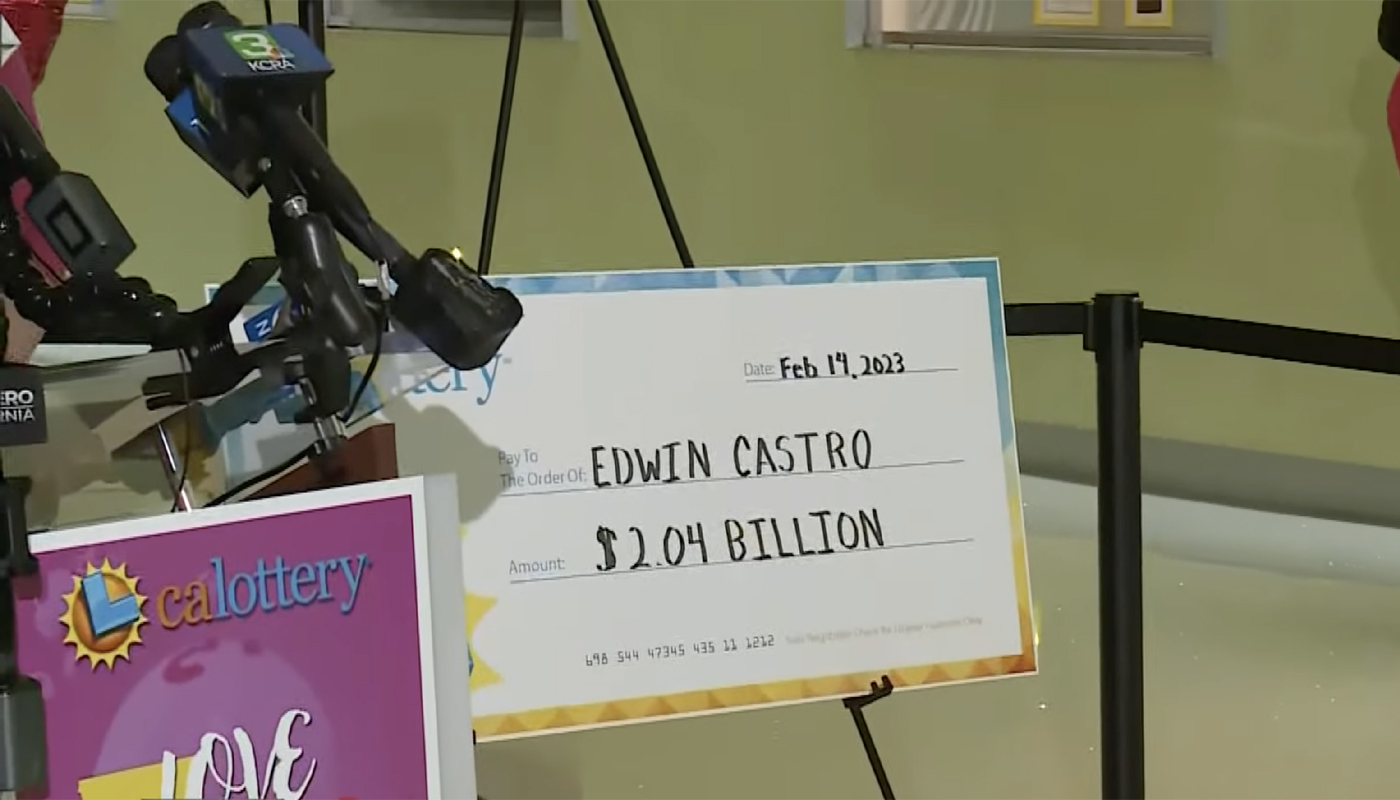

Second, the existence of SWS should not overshadow the statistical reality that coming into a large sum of money changes the vast majority of people's lives for the better. A bevy of academic studies over the past few decades testify to this, demonstrating that lottery winners—to cite one category of the suddenly wealthy—enjoy sustained increases in life satisfaction for years following their windfalls.

Perhaps the most important broader truth introduced by Goldbart and the MMCI is that, for all the obvious advantages it confers, sudden wealth does not necessarily simplify a person's life. They may achieve lifelong financial stability, gain access to new opportunities and experiences, and even position themselves to leave a unique, meaningful legacy, but they also must contend with novel emotional and interpersonal challenges.

Inheriting fortunes and coming into windfalls, that is, is not simply a matter of jet-setting around the world and luxuriating in the spoils of the high life. Our garish caricatures of new money notwithstanding, sudden wealth is an intricate, multifaceted experience, one with a great deal of psychological and emotional nuance that is frequently lost in a cultural discourse bent on romanticizing and pillorying affluence instead of endeavoring to understand it.

Comments