News writer; Opinion columnist

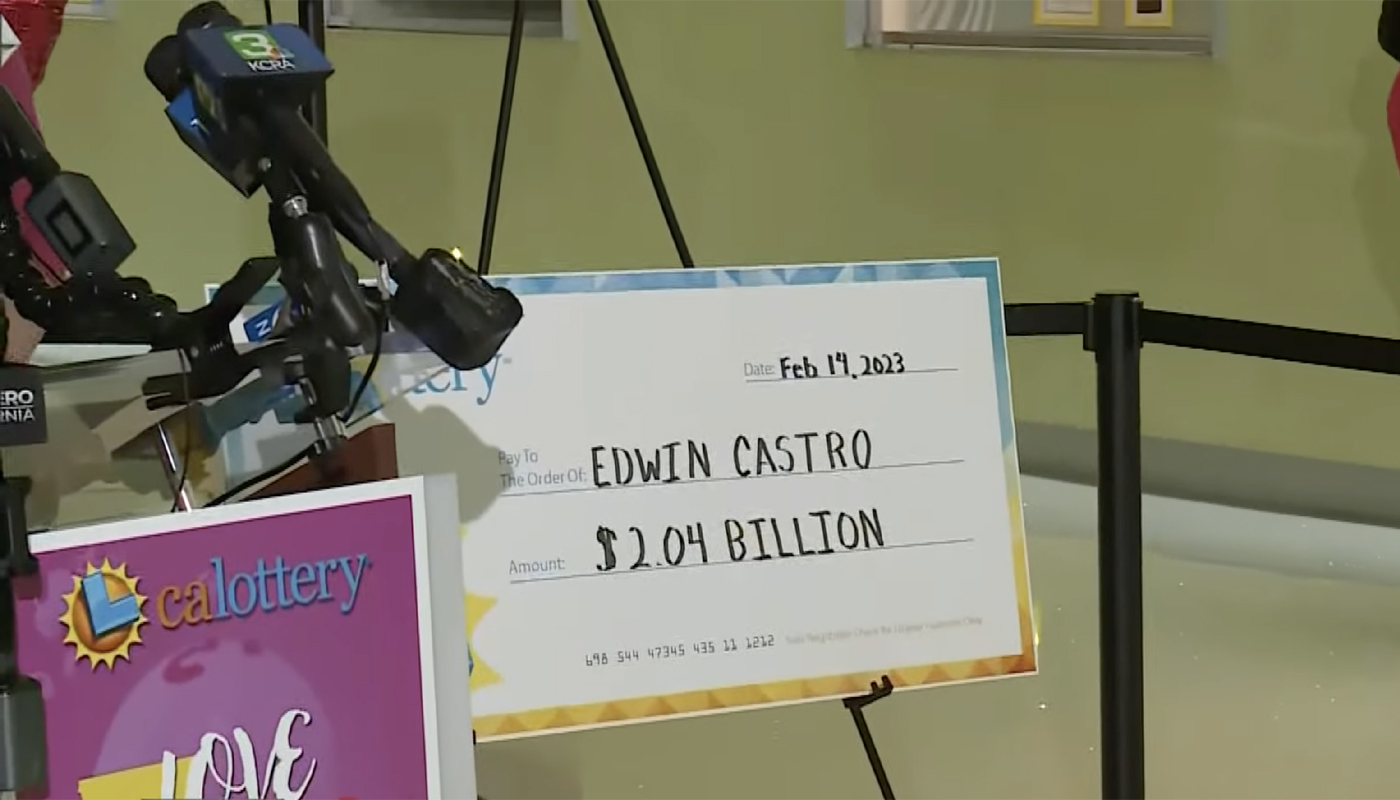

As everyone who follows the lottery even casually knows, a million-dollar jackpot isn't really worth one million dollars. That's because every lottery prize has two winners: the person who bought the winning ticket and the state and federal governments that will tax up to 40% of the entire win.

Understandably, some people don't like the idea of sharing a big win with people who have nothing to do with it. Sometimes, these winners will try to find creative (i.e., illegal) ways to avoid paying taxes on their jackpot.

These are true stories of lottery winners who tried, and usually failed, to dodge paying taxes on their big wins.

Big winner/big loser

Ohio resident Mustafa Shalash fumbled the bag when he decided that while a $700,000 lottery jackpot was good, a $1,000,000 jackpot was even better.

Shalash's misadventure began in 2015 when he won a two-million-dollar prize with a Powerball ticket. However, he was disappointed when, after choosing the one-time payout, he cashed in his ticket and received a check for just $710,000. When he asked what happened to the rest of his money, lottery officials told him that a portion of his winnings were being withheld to cover his IRS tax bill.

While most winners accept paying taxes as just the cost of doing business, Shalash decided that he was as entitled to the government's share of money as he was his own and concocted a scheme that he thought would win him the entire million-dollar prize.

The IRS considers gambling losses to be tax-deductible, and Shalash thought he could take advantage of this loophole to take back his missing $290,000 and claimed just over one million dollars worth of gambling losses on his 2015 tax return.

The IRS received his sham tax return and said one thing: “Prove it.” The problem with claiming massive gambling losses is that you need to provide actual evidence that you gambled, whether you can show that you're a frequent high roller in Vegas casinos or if you racked up big losses at the sportsbook.

Unfortunately for Shalash, he never thought through his master plan that far, and he was unable to show that he had any gambling losses beyond a few hundred dollars worth of lottery tickets. To make matters worse, Shalash attempted to conceal his real income by depositing hundreds of thousands of dollars into a bank account he controlled in Jordan. He concealed his ownership of the foreign bank account from the IRS, which is also illegal.

It didn't take long for the Feds to catch up with Shalash and his half-baked tax evasion scheme. FBI agents arrested him, and he eventually agreed to plead guilty in U.S. District Court in Columbus to a single felony count of making and subscribing a false return with the IRS. Bryant Jackson, a criminal investigator with the IRS, explained:

Concealing bank accounts overseas and inflating losses on a tax return is a recipe for criminal tax prosecution.

Fake winners

While it's typical to see real lottery winners underreport their winnings, the father-daughter duo from Florida, Danielle and Kenneth Edmonson, came up with a much more novel and, for a time, successful criminal scheme. While they never actually won the lottery, Danielle took to reporting massive lottery wins to the IRS and then demanding tax refunds. As we saw in the Shalash case above, when someone wins the lottery, taxes are automatically withheld by the IRS.

In the Edmonson scheme, Danielle would claim that she was entitled to the taxes that were deducted from her fictional lottery winnings. She claimed to have paid $145 million in taxes for the years 2015, 2016, and 2017 and demanded a refund of the withheld money.

One would think that the IRS would have a system for verifying if someone won the lottery, but one would be wrong because Edmonson's scheme actually worked, and in 2017, the Department of the Treasury sent her a check for $2.4 million.

Seeing the success of his daughter's scheme, Kenneth decided to get in on the action, and he submitted requests to the IRS for a refund of $725,111 based on taxes paid for non-existent lottery winnings. The government was so happy to comply with his request that they sent him a check for $734,266. As soon as the money hit their bank accounts, the Edmonsons went on a wild spending spree, purchasing luxury cars and enjoying exotic vacations.

But as the saying goes, play stupid games and win stupid prizes, and someone at the IRS seems to have finally decided to check whether the Edmonsons had won all of the money they claimed. When their scheme unraveled, the pair was arrested by the FBI and charged with filing false claims, mail fraud, and false statements.

As part of her defense, Danielle claimed that she was a Moorish Sovereign Citizen, which is a fringe political movement whose members claim that they are not subject to U.S. law or jurisdiction. Despite her handwritten letters claiming that the court had no authority over her, she was convicted and sentenced to six years in prison and ordered to pay restitution of $223,898.

Her father, Kenneth, was sentenced to four years and three months in prison and ordered to pay restitution of $5,000.

Win again and again and again and again

Despite the astronomical odds of actually winning the lottery, it's not unusual to see someone win more than once. After all, given that billions of lottery tickets are sold every year in the United States, it's not crazy that some people will be multiple winners. Even by that standard, however, Massachusetts resident Clarence Jones would be considered an extreme outlier. Over a three-year period between January 2013 and December 2016, he didn't just cash in one, two, three, or even one hundred winning tickets; he is credited with redeeming 4,670 winning lottery tickets worth approximately $6 million.

Now you don't need an advanced math degree or even a calculator to know that winning the lottery over 4,000 times is more or less impossible, but for some reason, it took Massachusetts Lottery officials a few years to catch on to the fact that Jones was benefitting from more than just a lucky four leaf clover.

Investigators finally launched an investigation into his unusual winning streak and learned that he was involved in a scheme known as “10 percenting,” where store owners purchase a winning lottery ticket from a winner for 80% of its total value. The scheme works because the original winner gets cash without having to pay taxes on it. The store owner then sells the ticket for 90% of its value to a courier, such as Jones, who cashes in the ticket, makes a 10% profit on the original prize, and assumes responsibility for the tax liability.

Between 2011 and 2017, Jones reported gambling winnings of $11 million, but he also claimed massive gambling losses, which offset his income from the winning lottery tickets, and he only paid a total of $16,000 in federal taxes. Eventually, prosecutors uncovered the full extent of his scheme, and Jones was arrested, along with his accomplices, George Kinslieh and Bhavna Patel, who were store owners who would buy lottery tickets from customers and sell them to Jones.

Rather than fighting the charges, Jones agreed to plead guilty to one count of conspiracy to defraud the United States and one count of filing false tax returns.

Jones' wife, Lynn, who lives in public housing after their home was destroyed in a fire, wrote an impassioned letter to the judge pleading for leniency. Lillie Jones wrote in a letter before her husband's sentencing:

We're old. We're frail. We're in poor health. The time we have ahead of us is far shorter than the time we've left behind. I just want it to be time we spend together.

Despite federal prosecutors requesting that the court sentence Jones to three years in prison for his central role in the scheme, the presiding judge showed leniency, giving him only two months.

Double steal

Almost everyone who follows the lottery is familiar with the story of Eddie Tipton, the Multi-State Lottery Association security director who hacked the lottery and engineered several wins for himself and his friends in the infamous Hot Lotto scandal. Tipton was eventually arrested, tried, and served five years in prison.

Texas businessman Robert Rhodes was a close friend of Tipton. Close enough that Tipton arranged for Rhodes to win the December 29, 2007, Wisconsin Megabucks drawing, which had a $2 million jackpot. After selecting the one-time payout and accounting for taxes, Rhodes took home the tidy sum of $783,000. In order to disguise his identity and his association with Tipton, Rhodes formed a limited liability holding company called Delta S Holdings to claim the money. Initially, the Wisconsin Lottery refused to pay an anonymous LLC, but Rhodes obtained a court order to force them to give him the money.

Now, most people who collected three-quarters of a million dollars without taking on any risk would, as the saying goes, take the money and run. Not so Rhodes. Apparently, he believed that one good crime deserved another, and he decided to push his luck just a little further.

Rhodes engaged in a complex scheme that involved depositing $450,000 of his lottery prize in an offshore bank account on the Caribbean island of St. Lucia. He then purchased a fake insurance policy for a corporation he owned, which did no business except for collecting his stolen lottery jackpot.

The insurance company, Bancroft Life & Casualty ICC Limited, then “loaned” Rhodes back $250,000 of his premium and allowed him to file an insurance claim worth an additional $75,000.

Finally, he reported the insurance policy as a business expense on his tax returns and claimed a deduction based on its value. The IRS accepted his claim, and the US Treasury paid him a refund of $150,000, in addition to a $36,200 refund he had already received from Wisconsin.

Tipton's lawyer, Dean Stowers, told reporters:

It's setting up a phony expense for a business that wasn't a true business so that somebody could claim a deduction they weren't entitled to. It's just another layer of fraud that Robert Rhodes was involved with.

However, just as one crime begets another, Rhodes' scheme unraveled when he claimed that the St. Lucia insurer he used to carry out his scheme stole the remaining $150,000 in his account. The ensuing investigation into Bancroft led law enforcement to Rhodes' tax fraud scheme.

Rhodes was arrested, pleaded guilty to tax fraud, and received probation for his crimes.

Comments